Fintech companies: agile and secure development by nearshoring

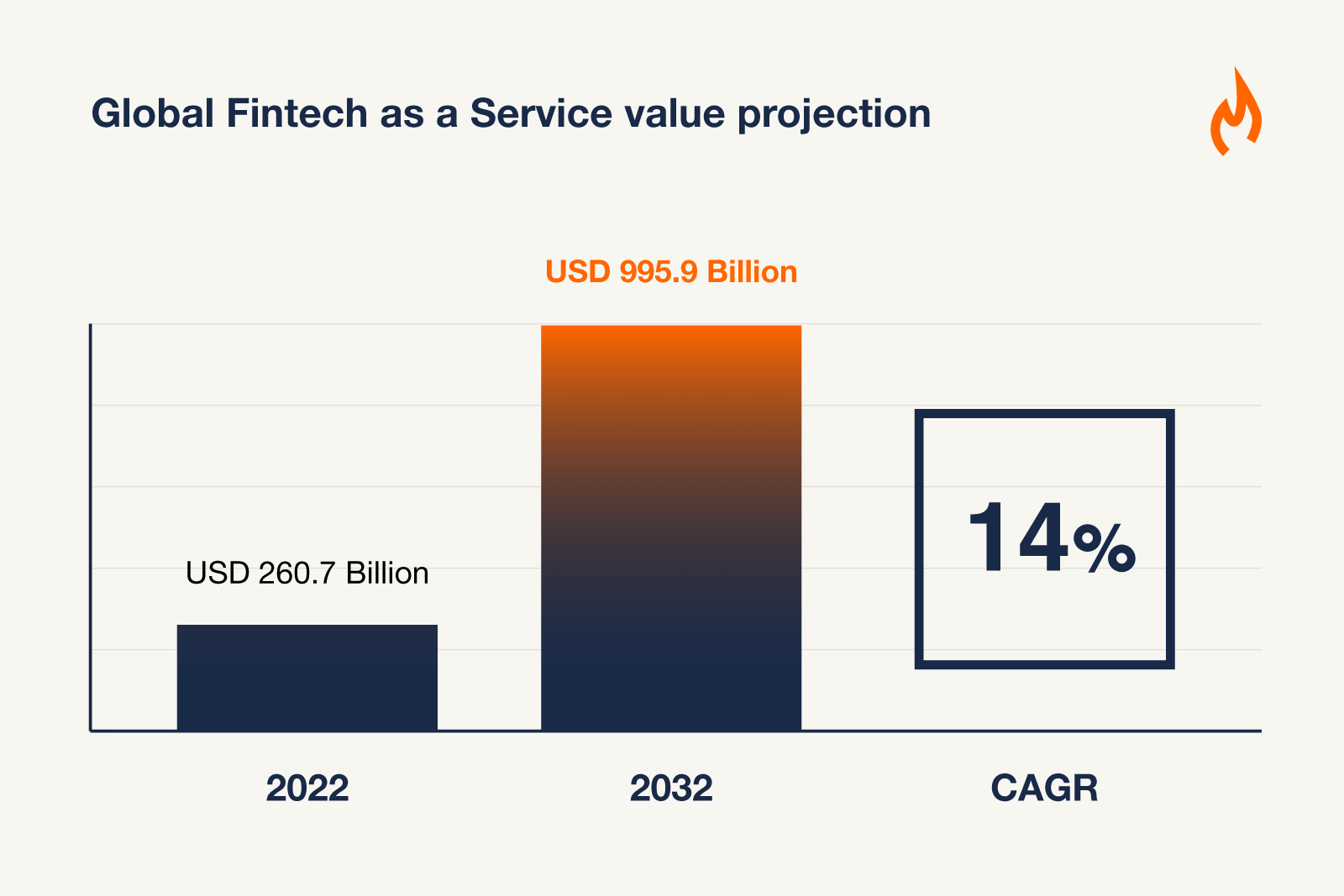

In the rapidly evolving fintech industry, companies are constantly seeking innovative ways to stay ahead of the competition and drive growth. One such solution that has gained traction is nearshore resourcing.

With its cost-effectiveness, specialized skills, scalability, and faster time to market, nearshoring has become a game-changer for modern fintech companies. But what exactly is nearshore resourcing, and how can it unlock the power of innovation and success in this highly competitive fintech sector?

In this blog, we will delve into the world of nearshore resourcing in fintech, exploring its benefits and uncovering the secrets behind its popularity.

Key Takeaways

Nearshore resourcing in fintech: an overview

Nearshore resourcing has emerged as a strategic model for fintech companies seeking to innovate rapidly while managing costs effectively. The fintech sector, characterized by its need for agility, compliance, and security, benefits from nearshoring by gaining access to specialized talent in similar time zones, facilitating real-time collaboration and quicker turnarounds.

Proximity reduces cultural barriers and improves communication, essential for developing complex financial technologies that must adhere to strict regulations. Nearshoring also offers scalability, allowing fintechs to adjust their workforce quickly in response to the industry’s dynamic nature while maintaining high-quality standards and intellectual property protection.

Why fintech companies choose nearshore resourcing?

Fintech companies especially, opt for nearshore resourcing due to the numerous benefits it offers, including cost savings, access to specialized skills, scalability, faster time to market, and enhanced innovation.

Nearshoring vs. offshoring – what’s the difference?

To optimize their development processes and drive their competitive advantage, fintech companies can leverage nearshoring to enable agile development methodologies. Agile development strategies focus on iterative and collaborative approaches, allowing for faster and more efficient software development cycles. Compared to offshore, nearshoring offers several advantages for companies seeking to implement agile practices.

| Nearshoring | Offshoring |

|---|---|

| Proximity to the home country enables real-time collaboration and faster decision-making. | Time zone differences may cause delays in communication and decision-making. |

| Cultural compatibility facilitates seamless integration and collaboration. | Cultural differences often lead to communication barriers and misunderstandings. |

| Access to a similar work culture and language proficiency improves team dynamics. | Language barriers and cultural differences may hinder effective team collaboration. |

Maximizing the time zone advantage

With the distinct operational tempo of the fintech sector, leveraging nearshoring for agile development demands a nuanced approach to time zone management. Here are three targeted strategies specifically tailored for fintech companies aiming to optimize their nearshore engagement:

Cultural compatibility in nearshore resourcing for fintech

Cultural compatibility plays a significant role in the success of nearshore resourcing for the fintech sector. We listed five key points highlighting its importance and how it manifests in this industry:

Understanding of financial regulations

Nearshore teams often have a better understanding of the financial regulations that are crucial for compliance in fintech operations. This knowledge is invaluable when creating products that meet legal and industry standards.

Alignment of business hours

The alignment of business hours between the nearshore team and the client is also significant. It facilitates real-time collaboration and communication, which is essential for the agile development practices that are typical in fintech projects. Quick response times and the ability to address issues as they arise help maintain a steady pace of development and innovation.

Shared economic context

Shared economic context is another advantage of nearshore resourcing in fintech. Teams from neighboring countries are more likely to understand the economic conditions that influence the fintech sector, leading to product features and services that are more relevant and finely tuned to the market’s needs.

Language and communication

Furthermore, language and communication ease due to cultural compatibility cannot be overstated. When nearshore resources share a common language or have high proficiency in the client’s language, it significantly reduces the potential for misunderstandings and streamlines the development process.

Cultural proximity in business practices

Lastly, the proximity of cultural and business practices greatly benefits project management and negotiations. As the fintech industry relies heavily on trust and user understanding, having a nearshore team with similar cultural values can enhance these aspects, leading to more successful products and services that align with user expectations.

Which are the leading fintech companies that successfully nearshored?

Revolut

Revolut, a British fintech company, has successfully nearshored part of its software development operations. They expanded their development team by nearshoring to various Eastern European countries, such as Poland and Lithuania, where they have set up offices. This strategy has allowed them to tap into a large pool of tech talent while maintaining close geographical and cultural proximity, facilitating easier collaboration and communication.

Klarna

Klarna, a fintech giant known for its smooth payment solutions, strategically nearshores software development to maintain agility and innovation. Leveraging global talent, they optimize costs and enhance product development cycles by collaborating with proximate, skilled developers who align with Klarna’s customer-centric, tech-forward ethos.

Conclusion

In conclusion, nearshore resourcing in the fintech industry offers significant advantages such as cost savings, access to specialized skills, scalability, and faster time to market. The nearshore resourcing model is compatible with agile development methodologies and provides a time zone advantage, cultural compatibility, cost-effectiveness, and scalability.

By leveraging nearshore resourcing, fintech companies can unlock faster growth, innovation, and success in a highly competitive market.